Consumers that have a credit history more than 680 will pay approximately $40 significantly more a month to your good $400,000 loan or higher

I discovered regarding the 2022 Western Society Survey one to 94.5 million house, otherwise 63 per cent out of occupied property, enjoys around three or even more bedrooms, that’s optimum for families which have pupils. But 56 per cent from owner-occupied residential property that have three or higher bedrooms just have one otherwise a couple of residents, most which are 62 and you may older.

Getting source, new median credit history in america was 710, definition it rule could be affecting most people having new mortgages

Consequently, old property owners try retaining the high-occupancy home, making the ilies buying brand new, larger payday loans bad credit South Coventry belongings, which in turn has actually the individuals families’ affordable starter house off of the markets. Whenever affordable property do get to the field, they may be offered so you’re able to large-size organization people that will spend cash, locking out brand new consumers instead present riches to attract out of.

Blaine’s Bulletin: Biden Home loan Equity Package

A major theme we come across to the Biden Management was security. Indeed, that is a phrase we quite often tune in to spouted in the mass media and political leftover. A phrase i really barely tune in to these days was equivalence. Because they search similar, the two conditions have quite other meanings. With regards to public plan, equality setting individuals are managed an identical under the laws the fresh new rules you to apply at in addition, you connect with me personally and everyone in america. The manner in which you live life lower than those individuals guidelines is up to your. Guarantee additionally setting no matter what conclusion you create and you may actions you’re taking, the federal government is just about to skew the law to make sure you as well as your neighbors whom made very different ple, you’ll find individuals who spared money, spent some time working compliment of college, and/or chose never to visit a several-year college or university who do not have college student debt. People is actually selection we’re all permitted to create due to the fact we are managed just as around you to definitely laws. But not, considering Chairman Biden to reach equity in america, the individuals just who did not save your self, did not works the ways as a consequence of college, and you may made a decision to pull out money to fund college or university will be not have education loan loans often. New equitable move to make will be to force taxpayers to safeguards people will set you back, that he is attempting to do. You may already know one package awaits a reasoning by Finest Legal.

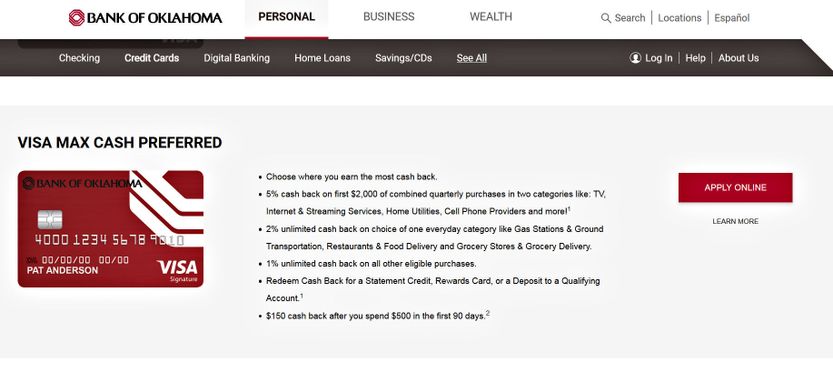

The fresh exemplory instance of which regarding the Light Home is its mortgage guarantee bundle. Several of you may have undoubtably heard of the fresh new code. In short, the brand new Biden Government is putting pass a policy you to pushes homebuyers that have a good credit score score so you’re able to subsidize the borrowed funds costs of men and women who do not have good credit scores. That most payment goes toward reducing payments away from those with tough credit scores.

This new director of one’s Government Housing Money Department (FHFA), the service one regulates federal home loan guarantors Federal national mortgage association and you can Freddie Mac, stated that this rule create increase prices service for purchase consumers simply for earnings otherwise of the wide range. Basically, this is the equitable course of action. But credit scores are present to own a reason, and you can current records has revealed the risk of individuals to find house they can not manage. A credit rating is actually an expression regarding somebody’s capacity to pay back financing based on credit history. It is important to note that credit scores aren’t tied up to income otherwise money. Some body, no matter its salary, is capable of a good credit score. For those who have repaid the money you owe making wise economic conclusion you made a premier credit rating. Don’t be punished which have large cost and also make up for all those who’ve not provided a choices. Including given the exposure a guy face while they are contributed to believe they could afford a house they actually cannot.

Leave Comment