Making use of a home Guarantee Financing for Debt consolidation

show which:

Property security mortgage will be a viable provider having homeowners in order to combine multiple expenses toward an individual, lower-attract monthly payment. By the tapping into your property collateral-the difference between their residence’s worth as well as your outstanding mortgage harmony-you can pay-off personal debt and you will get financial independence. This short article walk you through the procedure of deciding in the event the property collateral mortgage is the best monetary decision to suit your state because of the pinpointing compatible costs to have consolidation and you can outlining the application form techniques.

As to why Explore a house Equity Financing To pay off Obligations

Property guarantee mortgage was a monetary device which provides people a flexible choice to address individuals financial demands, including debt consolidation. This process should be such helpful whenever you are unable to would multiple expenses having varying rates.

Straight down rates of interest. High-attention expense can certainly result in monetary strain. Because of the consolidating these types of debts to the a home equity loan having good lower Annual percentage rate (APR), it can save you money on focus charge and you may reach greater monetary balances.

Smooth repayments. Balancing numerous payments is tricky. Consolidating your debts towards just one, foreseeable household guarantee financing fee streamlines your financial debt and you may decreases the possibility of missed repayments.

Repaired rate of interest shelter. As opposed to adjustable-rate expenses, a house collateral loan generally speaking includes a fixed interest. It indicates their monthly payment remains consistent, defending you from possible interest rate nature hikes.

Expense Best suited to own Consolidation

Domestic security financing are extremely advantageous to own consolidating specific types of obligations. By knowledge hence expense can benefit from this strategy, you could determine if a home security mortgage aligns with your economic requires.

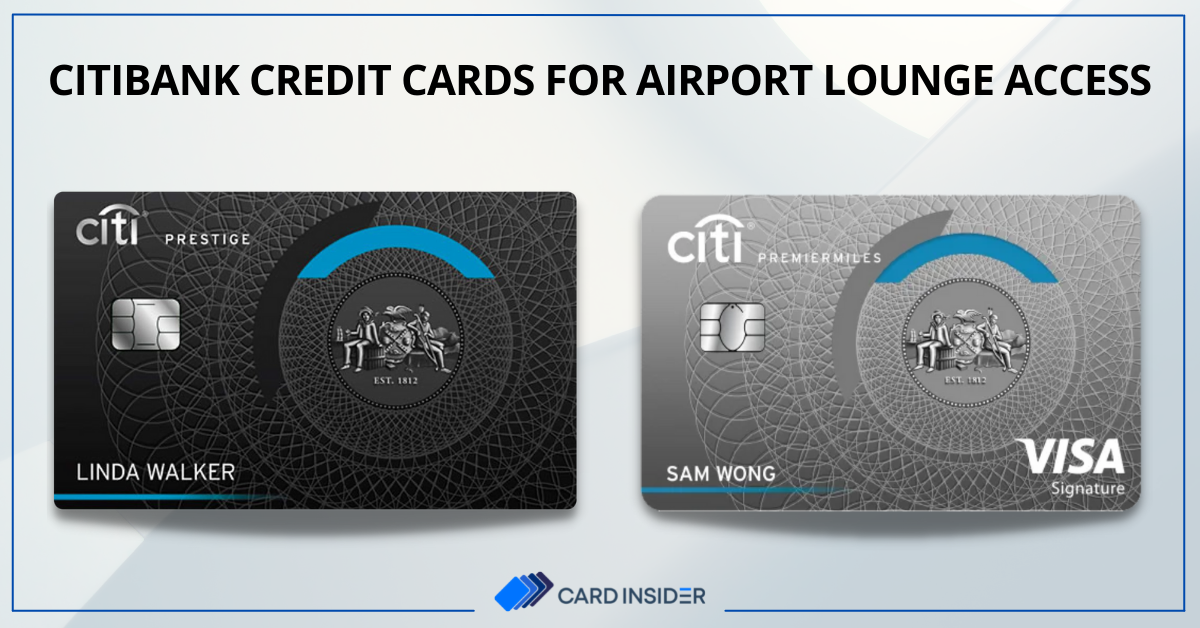

High-notice playing cards. Handmade cards that have significant interest levels is prime plans to have integration. By replacing numerous credit card stability with one household guarantee financing having all the way down pricing, it can save you significantly towards notice charges.

Unsecured personal loans. When you have numerous unsecured signature loans with a high interest rates, a home guarantee loan could offer less-rates solution. Combining this type of funds to your that repaired-speed percentage normally explain your financial government.

Medical obligations. Unforeseen medical costs are financially disastrous. A house security mortgage provide the mandatory loans to fund this type of costs, giving relief from highest-notice medical loans.

Constantly consider your much time-name financial package when deciding to have fun with a property collateral loan. While it are a useful monetary method, it is vital to end overextending yourself financially.

Don’t use a home Guarantee Financing for these Bills

House guarantee finance can be useful getting combination, however, they aren’t usually the best solution per obligations. Information when to stop a house collateral financing is a must having making advised conclusion.

Auto loans. As a result of the fast depreciation off automobile, playing with a property collateral financing to pay off an auto loan are high-risk. In the event your car’s value decrease shorter versus loan balance, could result in owing over the auto is worth.

Getaways. Borrowing from the bank up against the residence’s collateral to finance vacations, interests, or any other non-important costs may be not advised. This method expands your financial exposure and could threaten the homeownership for many who encounter financial hardships. Think a keen HFCU Special purpose Savings account once the a less hazardous way to save to own discretionary expenses.

Short-Term Loans. Domestic security fund can handle expanded-name debt consolidation reduction. On a single to settle short-term expenses, like handmade cards or loans that have lowest balances you can quickly pay back, is almost certainly not the quintessential efficient means.

High-Risk Investments. Borrowing up against your home’s collateral to pay for high-risk investment can be maybe not a good option. The chance of funding losses could jeopardize the homeownership.

Note: When you yourself have minimal guarantee in your home, a house collateral loan is almost certainly not possible. Imagine other debt consolidating possibilities, including balance import playing cards otherwise unsecured loans.

Knowing the Household Collateral Loan Processes

Using measures to help you combine the debt which have a home guarantee financing comes to an easy processes. Here’s an over-all overview:

step 1 | Determine Your house Security. So you’re able to calculate the offered security, dictate their residence’s market value and you may deduct the a good financial harmony. Really loan providers enables you to acquire a portion for the guarantee quicken loans Wellington, generally speaking anywhere between 80% and you can ninety%.

2 | Complete the Application for the loan. Offer personal information, possessions info, income confirmation, and other expected files with the lender. Be certain that the lender knows the borrowed funds is actually for debt consolidation. They are going to want to know you’re repaying other obligations whenever and work out their credit decision.

step 3 | Loan Recognition and you may Disbursement. Once acknowledged, you’ll receive the mortgage money since the a lump sum. Particular lenders may require you obtain the cash once the inspections written with the debtors you happen to be repaying.

4 | Debt consolidation reduction. Utilize the financing continues to repay established high-appeal costs, eg credit cards, personal loans, or scientific expense.

5 | Control your This new Financing. Build uniform monthly installments in your house collateral loan in order to maintain a good credit score and give a wide berth to potential penalties. If you reduced credit debt, you should never begin using the notes once more. Recall you only had off credit debt; you won’t want to lay yourself right back engrossed.

By following these tips and meticulously offered the money you owe, you could efficiently fool around with a house equity mortgage to help you consolidate and you will improve the debt management.

Prepared to talk about your home security choices to repay obligations and take power over your finances? Contact one of the mortgage benefits today more resources for domestic guarantee financing and exactly how capable benefit you.

Leave Comment