The Complete Guide on How to Do Forex Trading from Scratch

Contents

The market always opens on Monday when the Asian market opens and closes on Friday when the American session closes. Therefore, if you are in the United States, you can trade forex from Sunday to Friday . Minors – These are currency pairs of developed countries that don’t have the dollar.

The one exception being the Japanese Yen, with a Pip at 2 decimals. The largest quoted currencies – like EUR/USD and USD/JPY – are floating. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

The typical lot size is 100,000 units of currency, though there are micro and mini lots available for trading, too. The currency on the right (the U.S. dollar) is the quote currency. You would sell the pair if you think the base currency will depreciate relative to the quote currency. The second listed currency on the right is called the counter or quote currency (in this example, the U.S. dollar).

Fundamental analysts often examine relevant economic and financial factors, as well as other qualitative and quantitative information. Fundamental forex traders might be especially interested in economic calendars, such as the one shown below. The forex market is a world unto itself and has some substantial differences to other financial markets, such as the stock or commodity markets.

Analyze the market

The barter system, in which people would trade goods for other goods, first came into existence during the time of Mesopotamia tribes. For example, a person could exchange the US dollar for the Japanese Yen. Forex offers deep liquidity and 24/7 trading, so investors have ample opportunities to get involved.

When trading forex on our online trading platform, it’s worthwhile opening a demo account, which allows you to get accustomed to opening and closing trades, and practising your trading strategy. You can personalise our trading platform based on your preferences. The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities. Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC. A forex trading strategy should take into account the style of trading that best suits your goals and available time.

Calculating loss from your FX CFD

There are several things you need to know BEFORE you start trading forex. Second, these companies work with other players behind the scenes. For example, there are liquidity providers, banks, and software providers. Finally, there are traders who provide the capital and do the real trading. Therefore, in forex trading, your goal is to identify similar market opportunities using several types of analysis that we will look at later in this article.

Any trading strategy that leads you towards this goal could prove to be the winning one. Use our trading tools such as Stop Loss, Stop Limit and Guaranteed Stop to limit losses and lock in profits. Get FREE real-time forex quotes and set indicators to easily analyse charts. Trade the most popular forex pairs like EUR/USD, GBP/USD and EUR/GBP at Plus500.

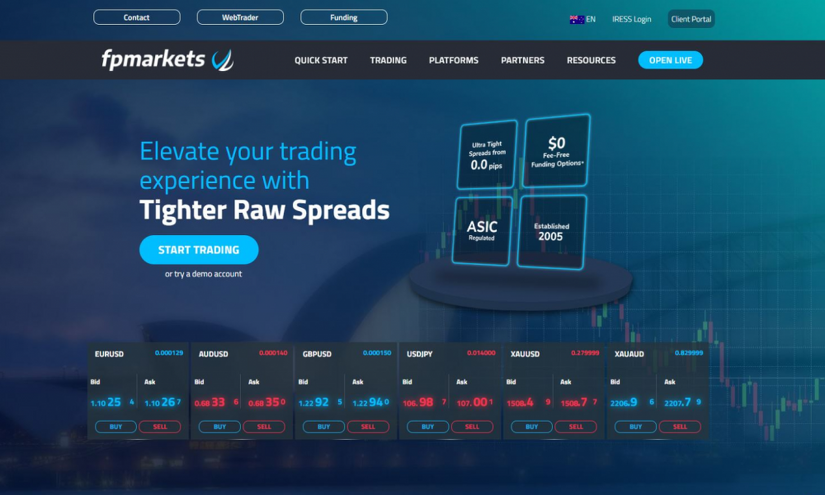

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. To begin finding a suitable broker, some of the best and most reputable online forex brokers are listed in the table what is fundamental trading in forex below that all offer excellent services to retail forex traders. Instead of executing a trade now, forex traders can also enter into a binding contract with another trader and lock in an exchange rate for an agreed upon amount of currency on a future date.

Market sentiment

With a TD Ameritrade account, you’ll have access to thinkorswim, a powerful trading platform where you can trade forex, as well as other investments. This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. One of the unique features of thinkorswim is custom forex pairing. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider.

Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in find a financial adviser question. Major currency pairs are generally thought to drive the forex market. They are the most commonly traded and account for over 80% of daily forex trade volume.

Multiple losses in a row

The foreign exchange is the conversion of one currency into another currency. This makes it easy to enter and exit apositionin any of the major currencies within a fraction of a second for a small spread in most market conditions. Here are some renesource capital steps to get yourself started on the forex trading journey. Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among other reasons.

Why do I keep losing money in forex?

Overtrading. Overtrading – either trading too big or too often – is the most common reason why Forex traders fail. Overtrading might be caused by unrealistically high profit goals, market addiction, or insufficient capitalisation.

These four currency pairs account for 80% — a strong majority — of forex trading, according to figures provided by IG. When you are trading Forex, you will need to choose a currency pair to focus on. Some traders will trade just one currency pair overall, but there is a whole world of good opportunities in the Forex markets. Because of this, traders will use a methodology or system to place trades and look for currency pairs that offer those setups. If you want to become a day trader you need to start small and work your way up. After practising for several months on a demo trading account, take the strategy you feel most confident with and some money you can afford to lose.

Popular Forex Trading Strategies For Successful Traders

All forex trading is conducted over the counter , meaning there’s no physical exchange and a global network of banks and other financial institutions oversee the market . Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders. They display the closing trading price for the currency for the time periods specified by the user.

The objective of forex trading is to exchange one currency for another in the expectation that the price will change. This analysis is interested in the ‘why’ – why is a forex market reacting the way it does? Forex and currencies are affected by many reasons, including a country’s economic strength, political and social factors, and market sentiment.

Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day. To excel in a forex trading career, you will need to be comfortable in a high-stakes environment and prepared to handle appropriate levels of risk in your trading. With large amounts of capital and assets on the line, having a calm and steady demeanor in the face of ebbs and flows in currency markets can be helpful.

As a beginner, it may be wise to trade the majors, as they’re known to be the most liquid and least volatile of the currency pairs. For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than in other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals that drive currency values, as well as experience with technical analysis, may help new forex traders to become more profitable.

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market. In the past, a forex broker would trade currencies on your behalf. But now there are lots of online forex brokers that offer trading platforms for you to buy and sell currencies yourself.

Position trading may be best suited to traders who spend more time understanding market fundamentals, and less time undertaking technical analysis or executing trades. No matter where you live, getting started as a retail forex trader is relatively easy if you have some risk capital, but trading currencies successfully requires considerably more than that. A “buy low, sell high” type of trading strategy, swing or momentum trading involves getting into and out of the market usually based on signals from momentum technical indicators like the RSI. Because forex trading requires leverage and traders use margin, there are additional risks to forex trading than other types of assets. Currency prices are constantly fluctuating, but at very small amounts, which means traders need to execute large trades to make money.

Position Trading

For example, EUR/USD is a currency pair for trading the euro against the U.S. dollar. A breakout happens after a currency pair has been in a consolidation phase for a while. Therefore, your goal will be to predict the direction of the breakout. At FXCM, we offer a collection of robust software suites, each with unique features and functionalities.

You can also sell about this number of dollars to buy 1 euro. Setting the stop loss will limit your losses if the market does not move in the preferred direction. Setting the take profit level will make sure that the trade exits in profit once the market makes the downward move that is expected. It can be an advantage to set these levels when you place the trade because once the trade is actually in the market, the pressure can make it difficult to make decisions. The very first step in making your first forex trade is opening the trading platform. But there are drawbacks as well — such as leverage, which can be a double-edged sword in that it can amplify both gains and losses.

Leave Comment