BB&T advises these money so you’re able to homeowners exactly who want to stay-in their brand new house having 3-5 years otherwise lengthened

New Part Banking and you will Trust Organization (BB&T) was based when you look at the New york during the 1872 since the Part and you can Hadley, that will be located in Winston salem, NC. It absolutely was one of the primary establishments in the us so you’re able to create a count on agencies. This new bank’s loan products are repaired- and you will changeable-speed mortgage loans, near to reasonable-prices solutions eg Virtual assistant loans. BB&T supporting consumers in search of strengthening, to acquire otherwise refinancing their houses.

BB&T Fixed Rate Financing

Fixed-rate funds are simple and easy-to-see a method to purchase a house. Individuals who London installment loan with savings account discover gradual grows within income over the years try a beneficial applicants to have repaired-price money.

These types of money can be found in 30- or 15-12 months terms and conditions, for choosing or refinancing home. Cost management and you can planning your economic coming getting somewhat simpler when prices was uniform, and this refers to a great mortgage kind of in order to safer whenever attract pricing are lower, once the they shall be secured inside the.

BB&T Variable Rate Money

Adjustable-rates mortgage loans (ARMs) are a good choice for homeowners that simply don’t want to be secured into the you to definitely speed immediately. There are several causes individuals may prefer to possess an adjustable payment per month. For example, somebody pregnant earnings grows in the future will benefit from an at first low-rate.

Pregnant a house revenue or refinancing is an additional great reasoning so you can match an arm in the place of a mortgage. BB&T offers step three, 5, seven and 10 season Case choices.

BB&T The fresh new Build Financing

Anyone purchasing a lot and money structure off a separate family thereon residential property is also create a property-to-permanent mortgage. Which financing option is in addition to suitable for financial support high-scale renovations. These finance come on a primary- and you will much time-term foundation and you can blend a single-seasons framework loan with a real estate loan since the latest building is performed.

BB&T Virtual assistant Funds

The latest U.S. Veterans Management promises a unique category of lenders to own energetic-obligations military users otherwise pros, National Shield officials otherwise set-aside players. These types of mortgage loans differ from other offerings in this needed lower or no down repayments and just have reduced credit and you may earnings conditions.

Supplied by BB&T due to the fact 15- otherwise 31-year fixed-rate finance, Virtual assistant fund are right for to get or refinancing a house filled of the applicant and you can keep the accessibility provide finance for the brand new advance payment.

BB&T USDA Fund

The newest You.S. Agency from Farming accounts for an alternate form of mortgage specifically made for all those trying relocate to rural parts. These types of fund offer the variety of freedom really possible property owners well worth, with as much as completely financial support readily available and you will current funds approved with the brand new advance payment. As opposed to Virtual assistant fund, USDA loans manage need financial insurance.

BB&T FHA Finance

The fresh Federal Casing Power is yet another bodies service that gives finance with just minimal conditions in order to consumers that simply don’t qualify for simple fixed-price mortgages otherwise Hands. For example USDA financing, FHA fund might need home loan insurance.

BB&T Dollars-out Refinancing Funds

Homeowners who’ve paid a few of its mortgages and need collateral to pay off financial obligation or make a primary get or resource are able to turn to bucks-out refinancing. This process concerns taking out fully a new financial to have a greater matter and having the real difference due to the fact equity.

As the home loan pricing are typically lower than attract with the debt, it an audio enough time-label monetary technique for some individuals.

BB&T Financial Programs

There are certain convenient equipment to have residents towards BB&T website. The lending company possesses an online mortgage form which fits for every user which have a qualified BB&T loan officer. The web based prequalification techniques is created not to ever apply to an individual’s credit score and you will spends economic questions to decide whether they meet the requirements to own a certain particular mortgage and home budget.

- Contact details and latest residence

- Precise location of the domestic concerned

- A position reputation and you may standard financial predicament

The entire mortgage process should be completed in an excellent paperless mode towards the BB&T site, that have electronic signatures reputation set for physical document signing. The brand new banknotes you to definitely the procedure is brief, and will simply take as low as thirty days, a lot more lower than the new 49-big date average cited by Ellie Mae for everyone home loan approvals.

The lending company is qualified by the Winston-salem Bbb, the brand new department closest in order to the headquarters. It has got acquired severe recommendations off users from the Better business bureau and you may retains an evaluation get of just one/5. The financial institution announced when you look at the 2016 it absolutely was part of a keen $83 million dollar settlement toward users out-of FHA funds.

However, the process inside it zero entry out of responsibility, together with bank launched it had been wanting to get well $70 billion in a connected amount.

BB&T Critiques and Problems

Founded in 1872 during the North carolina, BB&T is a financial and you may Faith serving sixteen Southern area and Midwestern says, in addition to Area regarding Columbia. Their Winston-salem head office is actually qualified by the local Better business bureau which have a the+ get. It offers stored this accreditation since the 1974 and has a customer review score of just one/5.

It has acquired 745 Bbb issues and you can 61 feedback. The lending company responses problems facing it, some of which are believed resolved while others only responded. The lending company reacts so you can the product reviews, however publicly, only proclaiming that was reaches over to disappointed customers.

BB&T Financial Certification

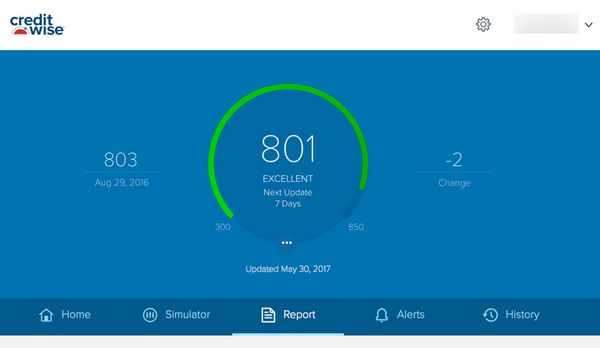

BB&T also provides multiple option investment choices for individuals whom satisfy a kind of certificates. Somebody armed forces members, pros, men and women surviving in outlying components or which qualify for FHA guidelines may also qualify for these types of special options qualified due to bodies providers. BB&T now offers a review off credit rating supports.

Leave Comment