Your interest rate should determine just how much you will end up using to invest in your house financing ultimately

Select Low-Interest rates

Notice is often a component that you ought to thought any moment that you will be investing in a cellular financial-or whichever mortgage, for instance.

Whenever a lender offers a mobile home loan, you can expect to pay interest. This is why lenders make their money to your services out-of offering you a loan to help you move in at some point alternatively than afterwards. The rate of interest that you’ll spend may differ toward various affairs, including credit history or risk history.

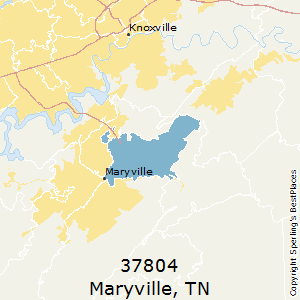

Before you choose to invest in the cellular family, you really need to function with your financial situation. If you find yourself mobile mortgage brokers are a good option for individuals who don’t have the ideal fico scores otherwise that do not need certainly to spend higher off costs, you can buy a far greater offer after you consult a loan along with your money inside good acquisition. This is simply not a necessity whenever choosing a cellular home loan, but if you require a low-value interest, it can yes assist.

The way to lower your rate of interest is always to generate certain that you are an ideal candidate to own loan recognition. To do this, do your best to improve your credit rating in advance of applying. You can do this by paying out-of established expense being in control on the into the-time payments. Additionally be smart to establish good deposit to get a better offer also!

Choosing the best Alternative

Before you sign into a cellular mortgage, it’s always best that you know what you qualify for and what your options are. Mobile lenders becoming smaller than old-fashioned mortgage brokers setting your could possibly score significantly way more to suit your currency than you if not manage. The majority of people realize that they may be able be able to funds loans in Castle Pines a great amount of improvements on the homes.

When you’re cellular land with come owned are an option, you may be astonished to find out that they are ordered new getting an amazingly sensible rate. Of several residents find they may be able be able to completely personalize their own brand-new mobile family during the a rather great price. This means that you can purchase exactly what you desire having an expense that one can afford.

To fully see your house experience, you should manage locating the best you can easily balance anywhere between comfy way of living and you will funds. The brand new happiest home owners is actually individuals who rating as much as they require for a price one to feels comfortable. It means making decisions to suit your cellular house that don’t drive new funds way too high but still meet your own extremely important need.

While you are sorting away what’s going to work for you, it is important to consider your latest economic climate and you will where you want to see it wade. Mobile lenders can offer reduced monthly obligations, leading them to great for those who are trying spend less or cut down on month-to-month expenses. Of course, you can always invest in upgrades that can increase the rates if you possibly could get it done conveniently. Think about what we want to pay per month and you may exactly what it would mean for the economic coming.

Work with a cherished Finance Lender

To seriously make use of their cellular home loan, we wish to run a lender you could believe. A lender one places users first will allow you to get an extraordinary bargain, regardless if you are searching for a fundamental cellular home otherwise want every special features. Loan providers provide unbelievable knowledge on the capital procedure that assist you to ideal know the choices.

Leave Comment