FHA-covered loans appear off most lenders exactly who bring traditional fund

Which have an adjustable-rate home loan (ARM), the speed changes periodically. He could be typically characterized by the full time that must ticket before speed would be changed (step one, step 3, 5, eight otherwise ten years, particularly). Costs are often below fixed-speed mortgages, however, bring the danger one an increase in interest levels usually lead to large monthly obligations.

FHA-Insured Money

The new Government Casing Government (FHA) also provides numerous lower-down-percentage financial issues for qualified participants. Having advice and you can qualifications conditions, speak to your lender otherwise go to:hud.gov/fha.

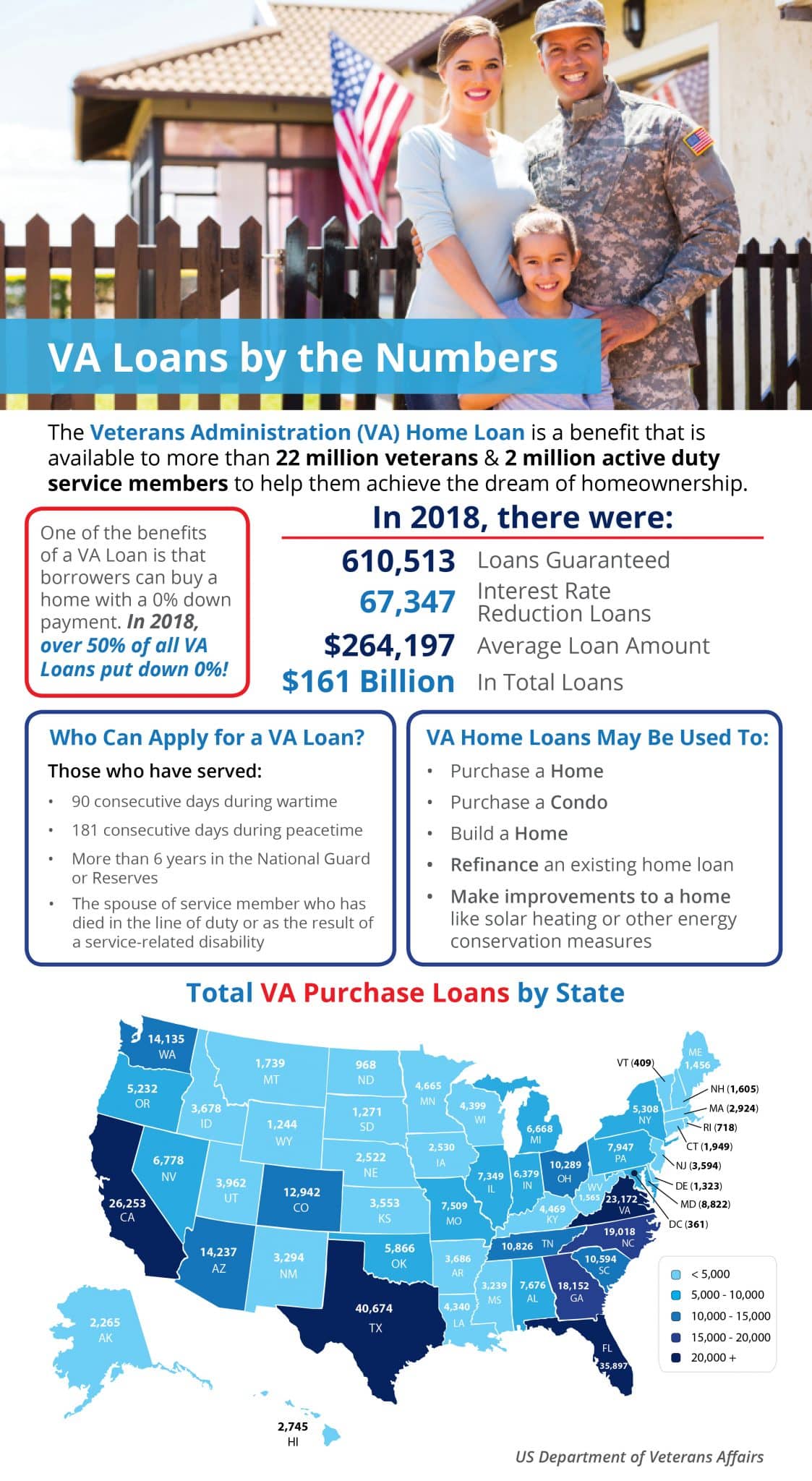

VA-Secured Fund

If you find yourself a seasoned out-of army provider, reservist, otherwise into active army duty, you’ll be able to qualify for that loan be certain that in the Agency from Veterans Things. This type of funds enjoys low-down repayments.

Inspection reports

Lenders may require which you have their possible house examined from the an expert prior to they accept your own mortgage. Although they will not, choosing an inspector is a good means to fix include forget the. They might know structural, electric otherwise plumbing system problems that you can expect to affect the conversion process rates. However, a comprehensive review is useful in different ways. The final statement would be a strategy to own some thing the consumer is thinking about four or even more ages down the road, such as for instance installing an alternate roof, furnace or hot water heater. Inspection reports, and that generally costs ranging from $3 hundred and you will $600, can also be tell you architectural issues that get change the price and you may your need for your house. House inspectors try registered from the condition.

Around Wisconsin laws, strengthening inspectors is actually accountable for damages one to happen from a work otherwise omission relating to their check. On the other hand, they are blocked out-of creating any fixes, maintenance otherwise developments towards checked assets for around two many years pursuing the examination has actually took place.

To find out more from the statutes or even see the condition off an enthusiastic inspector’s licenses, excite call (608) 266-2112 or browse “home inspections in the: dsps.wi.gov.

First-Big date Homebuyers

Purchasing your very first domestic might be problematic given the information in addition to money you’ll need for an advance payment. Fortunately, the condition of Wisconsin has the benefit of educational and you can financial help from Wisconsin Property and Financial Development Service. To learn more, visit: wheda/homeownership-and-renters/home-people

Preferred Monetary Terms

- Annual percentage rate (Annual percentage rate): Whilst includes points, expenses or other will cost you energized because of the bank, this is actually the real interest rate you may be using. While the all of the lenders have to calculate payday loans Plantsville no bank account accurately this profile the same way, the fresh new Apr provides good means for contrasting mortgage proposals.

- Appraisal: An offer of the property’s market value in accordance with the standing of the build, the worth of brand new house in addition to features of your area. Appraisals are requisite while a property is bought, ended up selling otherwise refinanced.

- Assumable Mortgage: A home loan that can be taken over of the customer to own a fee. These mortgage loans prevent closing costs and financing costs.

- Closing costs: Money generated into the closing go out to pay for lawyer fees, appraisals, credit file, escrow fees, prepaid service insurance fees or other fees

- Popular Area Examination: Known as resident relationship costs, talking about charge paid back because of the product people in order to maintain the house or property.

- Downpayment: The level of cash repaid by citizen at that time out of closure. One down payment that’s below 20 percent of your own price constantly means mortgage insurance policies, which boosts the client’s monthly premiums.

- Escalator Term: A supply enabling the lender to change the attention cost or perhaps the quantity of the loan if the markets standards alter.

- Fixed-Rate Home loan: Financing which have a fixed rate of interest that remains constant over the life of your own mortgage.

Leave Comment